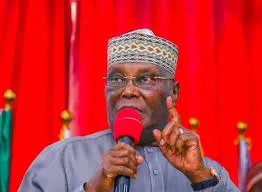

Economic Concerns: Atiku Critiques 2025 Proposed Budget

Former Vice President Atiku Abubakar has criticized Nigeria’s proposed 2025 budget, describing it as inadequate for addressing the nation’s structural challenges and a continuation of “business-as-usual fiscal practices” by the APC-led administration.

The proposed budget outlines ₦48 trillion in spending, with a revenue forecast of ₦35 trillion, resulting in a deficit exceeding ₦13 trillion.

To bridge this gap, the government plans to borrow over ₦13 trillion, including ₦9 trillion in direct loans and ₦4 trillion for project-specific financing.

Atiku argues that this approach mirrors previous administrations, exacerbating public debt and increasing risks related to interest payments and foreign exchange exposure.

Atiku highlights several key issues with the budget:

- Weak Budgetary Foundation: He points out that the 2024 budget’s underperformance, with less than 35% of capital expenditure disbursed by the third quarter despite claims of 85% execution, undermines confidence in the 2025 plan.

- High Debt Servicing Costs: The budget allocates ₦15.8 trillion (33% of total expenditure) to debt servicing, nearly matching the capital expenditure of ₦16 trillion (34%). This disproportionate focus crowds out essential investments and worsens the debt cycle.

- Bloated Recurrent Expenditure: Recurrent spending remains excessively high at ₦14 trillion (30% of the budget), fueling inefficiencies and sustaining an oversized bureaucracy, leaving limited resources for development.

- Insufficient Capital Investment: Capital investment accounts for just 25% to 34% of the budget, which Atiku believes falls short of addressing Nigeria’s infrastructure needs and cannot drive growth.

- Regressive Tax Policies: He criticizes the planned VAT increase from 7.5% to 10%, calling it a regressive measure that will worsen the cost-of-living crisis and stifle economic growth by imposing additional tax burdens on an already struggling populace.

Atiku concludes that the budget lacks the structural reforms and fiscal discipline needed to confront Nigeria’s economic challenges.

He urges the government to prioritize reducing inefficiencies in government operations, tackle contract inflation, and focus on long-term fiscal sustainability rather than perpetuating unsustainable borrowing and recurrent spending patterns.