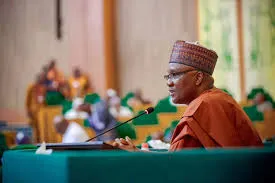

Reps Move Forward with Tax Reform Bill Approval

The Nigerian House of Representatives has passed four significant tax reform bills aimed at overhauling the country’s tax system. These bills, initially proposed by President Bola Tinubu in October 2024, are designed to enhance government revenue, streamline tax collection, and adjust tax rates across various sectors.

Key Components of the Tax Reform Bills:

- Nigeria Tax Bill 2024: This bill sought to gradually increase the Value-Added Tax (VAT) from the current 7.5% to 12.5% by 2026, with further increments leading up to 15% by 2030. However, after deliberations and public feedback, the House retained the VAT at 7.5%.

- Tax Administration Bill: Aims to streamline the assessment, collection, and accounting processes for revenues accruing to the federation, states, and local governments.

- Nigeria Revenue Service Establishment Bill: Proposes the establishment of the Nigeria Revenue Service, replacing the Federal Inland Revenue Service, to enhance efficiency in tax administration.

- Joint Revenue Board Establishment Bill: Seeks to establish a Joint Revenue Board, the Tax Appeal Tribunal, and the Office of the Tax Ombudsman to harmonize, coordinate, and settle disputes arising from revenue administration in Nigeria.

Distribution of VAT Revenue:

The initial proposal allocated VAT revenues as follows

- Federal Government: 10%

- States and Federal Capital Territory (FCT): 50%

- Local Governments: 35%

However, the House revised this distribution to:

- Federal Government: 10%

- States and FCT: 55%

- Local Governments: 35%

Next Steps:

Following the House’s approval, the bills will be transmitted to the Senate for concurrence. Upon Senate approval, they will be sent to President Tinubu for his assent to become law.

These reforms are part of the administration’s efforts to improve Nigeria’s tax-to-GDP ratio, which currently stands at 10.8%, one of the lowest globally, thereby reducing reliance on borrowing to fund the budget.

For a more detailed discussion on the passage of these tax reform bills, you can watch the following news segment: