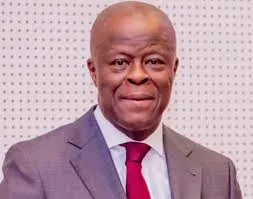

Edun Confirms Luxury Goods Tax Hike to 15%

Nigeria’s Minister of Finance, Wale Edun, has confirmed plans to raise the Value Added Tax (VAT) to 15% on luxury goods as part of the government’s efforts to boost revenue.

This proposed increase targets high-end goods and services to ensure that the wealthier segment of the population contributes more to the nation’s finances.

The hike is part of a broader strategy aimed at fiscal consolidation and economic stabilization.

By focusing on luxury goods, the government hopes to generate additional revenue without disproportionately affecting the general populace.

However, there are concerns about the potential impact on businesses in the luxury sector and whether this policy will adequately address Nigeria’s revenue needs.

This move aligns with the government’s ongoing fiscal reforms, which also include reducing public sector inefficiencies and diversifying revenue sources beyond oil.

Raising VAT on luxury goods could potentially increase government income while encouraging a more equitable distribution of tax burdens.

Leave a Reply