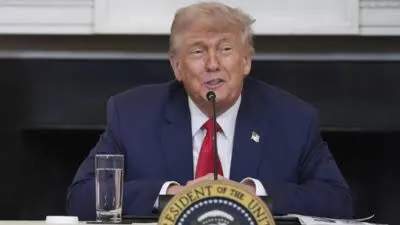

The Impact of Trump’s $1,000 Baby Accounts

Here’s what you need to know about Trump’s announcement

🍼 What Trump Is Proposing

- “Trump Accounts”: A one-time, $1,000 government contribution into a tax-deferred investment account for every U.S. child born between January 1, 2025, and January 1, 2029 (theguardian.com).

- These accounts would track the overall stock market, with meaningful growth potential if the market performs well (theguardian.com).

- Guardians manage the accounts, and additional private contributions (from family, employers, etc.) up to $5,000 annually are allowed (theguardian.com).

👥 Who’s Backing It

- Major businesses like Uber, Goldman Sachs, Dell, and Robinhood are pledging billions to support these accounts for employees’ children (theguardian.com).

- Speaker Mike Johnson called it a “transformative policy” offering newborns a financial head start (abcnews.go.com).

🇺🇸 How It’s Funded

- This is part of Trump’s sweeping “one big, beautiful bill”, which also includes tax cuts and welfare reforms (theguardian.com).

- It passed the House but now faces resistance in the Senate, with concerns over its impact on the federal budget deficit—a Congressional Budget Office estimate says it would add $2.4 trillion over 10 years (theguardian.com).

🧠 Context & Comparisons

- Similar ideas have exists elsewhere:

- The UK’s Child Trust Fund (2002–2011)

- Singapore’s Baby Bonus Scheme (theguardian.com).

- Financial experts note that using low-cost index funds helps keep fees low and growth potential aligned with the broader market’s performance.

✅ Bottom Line

Trump’s plan aims to jump-start savings for children with $1,000 seed money, plus up to $5,000/year in private contributions. It’s framed as a pro-family initiative, but hinges on a larger legislative package and raises questions about cost and effectiveness.

Let me know if you’d like a breakdown of the legislative obstacles, expert opinions, or how this compares to existing child savings plans around the world

Leave a Reply